Cities across North America are experiencing a property boom. Commercial, retail, and vacation rental properties are being snapped up left, right, and center. Amongst this buying surge, patterns have emerged and they’re centered in what the industry calls ‘gateway markets’.

As far as real estate markets go, a gateway market is a great market to invest in. Most real estate markets across the world can be divided into commercial real estate investment and residential real estate investment. No matter which real estate market you decide to invest in, research is a key factor. The gateway real estate market is a profitable one, but you will need to put in the time to ascertain which market is the right one for you.

In this blog post, we’ll go over the idea of gateway markets, what they are, why they’re important, why you should invest in them, and where are the biggest gateway real estate markets in North America.

What is a Gateway Market?

If we want to understand why gateway markets are so important for real estate investment, we first need to understand what characteristics underpin the gateway market concept. The definition of a gateway market differs according to who you ask, but the general consensus is that the term refers to a highly-investable real-estate market. Of course, there are more specific characteristics but that is simply a general definition.

According to Sonny Kalsi, via his website, the other characteristics include:

-

These markets have a high liquidity level, which means that real estate is easily bought and sold. In other words, it means that gateway markets are always popular with investors.

-

Gateway markets are usually cities with considerable status, like New York and Los Angeles.

-

These markets also often have social, economic, and political influence.

Why Should I Invest in a Gateway Market/Gateway Markets?

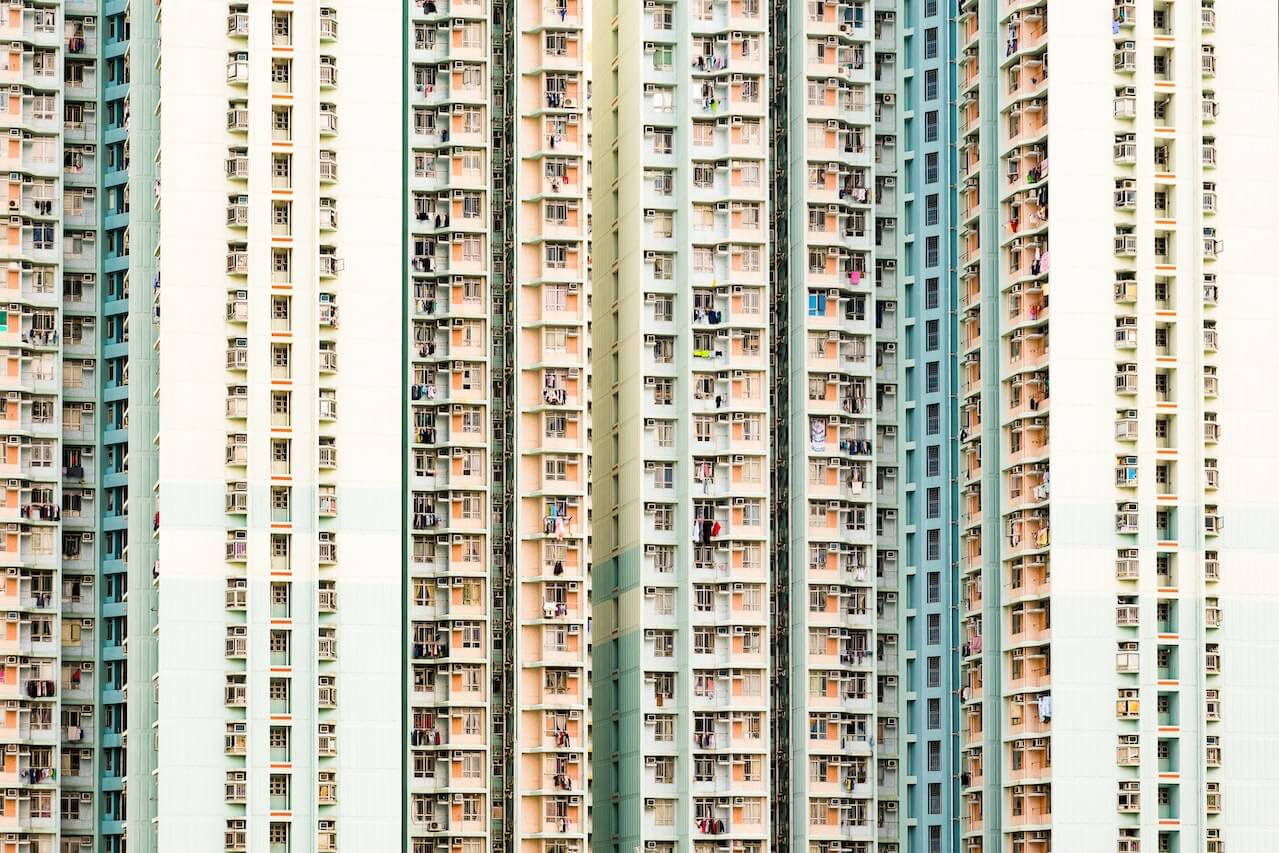

The characteristics of gateway markets are the very things that make them supremely investable. These real estate markets are attractive to more than just real estate investors. They usually have very high population densities and are often very busy tourist cities too, which is what makes them such great real estate markets to invest in.

In the short-term rental market, popular markets represent the opportunity to make a lot of money. Unfortunately, they also come with a particularly high level of competition. But there are things you can do to give yourself the best chance of scoring as many bookings as possible.

Gateway markets are characterized by high levels of liquidity, but what does that mean? Market liquidity is, according to Wikipedia, “a market’s feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset’s price.”

MillionAcres.com says the following about gateway market investing – “It takes an experienced investor to know which markets to target, what projects to develop, and how to serve the community in a profitable and successful way. If you believe a gateway city could be a worthwhile investment, speak with a local real estate agent or reach out to the area’s gateway city council to learn more about the values of real estate, neighborhood needs, and opportunities before investing.”

Investing in a gateway market can offer several advantages and opportunities for real estate investors. A gateway market refers to a city or region that serves as a strategic entry point to a larger geographic area or market. These markets are often major economic centers, transportation hubs, or locations with significant business and cultural connections. Here are some reasons why investing in a gateway market can be beneficial:

-

Access to Larger Markets: Gateway cities are often connected to larger regional or global markets. Investing in these markets can provide you with opportunities to tap into a broader customer base and expand your business beyond the immediate area.

-

Economic Stability: Gateway markets tend to be more economically stable compared to smaller or less-developed areas. They usually have diverse industries, a robust job market, and higher levels of infrastructure and amenities, making them attractive to businesses and residents alike.

-

Enhanced Infrastructure: Gateway markets generally boast better infrastructure, including airports, seaports, highways, and public transportation networks. This infrastructure can facilitate the movement of goods and people, making it easier to conduct business and attract investment.

-

Higher Demand for Real Estate: Gateway cities often experience a higher demand for real estate due to the influx of businesses, tourists, and residents. This demand can lead to potential appreciation in property values and rental income for real estate investors.

-

Cultural and Business Connectivity: Gateway markets tend to be cosmopolitan cities with diverse populations and extensive business networks. This creates a fertile ground for collaboration, innovation, and cross-cultural exchange, fostering a vibrant business environment.

-

Attraction for Foreign Investment: Gateway markets are typically attractive destinations for foreign investors. As these cities act as major gateways for international trade and commerce, they often benefit from significant foreign direct investment, which can positively impact the local economy.

-

Resilience in Economic Downturns: Due to their economic diversity and size, gateway markets often exhibit more resilience during economic downturns compared to smaller, less-developed regions.

-

Access to Skilled Labor: Gateway cities are magnets for skilled professionals from various industries. By investing in such markets, you gain access to a larger talent pool, which can be beneficial for businesses looking to hire skilled workers.

-

Potential for High Returns: While gateway markets may have higher upfront costs, they can also provide the potential for substantial returns on investment over the long term due to their growth prospects and economic stability.

It’s essential to conduct thorough research and seek professional advice before making any investment decision. Gateway markets can be competitive and dynamic, so understanding the specific market trends, regulations, and potential risks is crucial for successful investing.

What Are ‘Secondary Markets’ and Are They Important?

According to SecondRE, secondary markets occur “when investors buy out existing investors in an active project. It is called secondary because the primary transaction occurred when the initial investor made his investment with the sponsor.

For the gateway real estate market, secondary markets represent a way to buy into an existing project, with most of the groundwork done already. By ‘groundwork’, we do not necessarily mean actual building work, but rather administrative work like permits and tax concerns.

Secondary markets are especially useful for individuals targeting commercial real estate investment.

What Are the Main Gateway Markets in the United States?

-

Boston, Massachusetts

Boston is a great investment for real-estate owners. There are no major restrictions on short-term renting in the city, but be aware that hosts who rent for periods under 28 days will need to register. According to our Markets page, the Average Daily Rate in Boston is $153, and the most common Length of Stay durations are 30+ nights (31%) and 2 nights (26%). -

Chicago, Illinois

Chicago has a slightly lower Average Daily Rate than Boston, sitting at $102. The total number of listings (at the time of writing this) in Chicago is 3,555 with 1,751 of those listings being classified as one-bedroom listings. Remember, we only consider ‘entire property’ listings. -

San Francisco, California

San Francisco is an extremely popular city. On an annual basis, it attracts over 22 million visitors every single year. In real-estate terms, San Francisco is a good investment for many reasons. The popularity with tourists, the local attractions, the location, and the price of accommodation are just a few of the reasons that tourists love San Francisco.The Average Daily Rate in San Francisco is $459, with 5,514 listings active at the time of writing this post. The most common Length of Stay duration in the city is 30+ days, with a total of 43% of hosts opting for this minimum.

-

Malibu, California

Malibu is famed for beaches, sunshine, and its iconic coastline. While most of Los Angeles has strict Airbnb restrictions, the Malibu City Council allows short-term rentals provided that hosts register their STR business. -

Nashville, Tennessee

Nashville is an iconic city and attracts thousands of visitors each year. The Average Daily Rate in Nashville at the time of writing this feature is sitting at $234 with an average market occupancy rate of 55%. The most popular days are Friday and Saturday, and hosts in the area charge more for both of these nights. The average minimum night stay requirement is two nights, with a 49% majority. -

New Orleans, Louisiana

Another iconic city, New Orleans might be more seasonal than Nashville but it still boasts some impressive investment statistics. The occupancy rate sits at 63% with an Average Daily Rate of $185. A majority of 41% of listings require a 2-night stay minimum and prices climb on Thursday, Friday, and Saturday nights as these are the most popular.

What Are the Main Gateway Markets in Canada?

-

Whistler, British Columbia

Whistler is one of the best-known tourist markets in Canada. It boasts one of the biggest ski resorts in North America and has been the winter destination of choice for Canadians and Americans alike for years. As an investment proposition, Whistler is a solid choice. According to our Markets page, Whistler is currently sitting with an occupancy rate of 63% and an Average Daily Rate of $403. The most popular – and most expensive days – nights are Friday and Saturday. Whisler’s minimum night stay requirements are shared reasonably evenly between 2 and 3 nights. -

Montréal, Québec

The two biggest cities in Canada, Toronto, and Vancouver, both have restrictions on Airbnb renting. Montréal does not. According to TheTravel.com, Montréal-Trudeau Airport saw 19 million visitors in 2018. Of course, the pandemic drastically reduced this but generally speaking, Montréal enjoys a steadily high number of visitors. We’ve tracked 4,449 active vacation rental properties in Montréal, with 2,363 of them being one-bedroom listings. The Average Daily Rate sits at $104 with an occupancy rate of 44%. The market’s minimum night stay requirements are spilt between 1, 2, and 30+ nights with 26%, 26%, and 25% respectively. -

Québec City, Québec

As seen in Montréal, Québec City does not have any restrictions on short-term renting. It attracts over 4,000,000 visitors on an annual basis and the vacation rental market benefits from that steady flow of tourists. The Average Daily Rate sits at $148 with an occupancy rate of 44%. Most hosts in the area have opted not to implement a minimum night stay requirement.

These are not the only viable and investable real estate markets in North America, they

How Can DPGO Help?

We will keep updating our list of gateway real estate markets as the year goes on. In the data game, things change fast and that’s why dynamic pricing from DPGO will keep you competitive 24/7, 365. To register now for a free 30-day trial, click the banner above and get started on earning more money! All we need from you is your Airbnb listing URL so we can analyze your local market and once we’ve created our recommendations, you can review them and decide how you want your dynamic pricing system to operate!

We also have a free usage plan which gives you access to all the data that you want and need to make your business as successful as can be! You can view the details of our free usage plan, and the rest of our payment options, here.

7 Comments

Pingback: 5 Beginner Real Estate Investing Strategies

Pingback: 3 Reasons Why Real Estate Is a Good Investment Right Now

Pingback: Things You Need to Learn About Real Estate Investing - Ultimate Status Bar

Pingback: Turn Your Property into a Vacation Destination and Profit from It - NewsCreds

Pingback: What are tenants looking for in a rental property? – DS News

Pingback: 8 Secrets Of Successful Property Investing | Mashhap

Pingback: Freelance Business: A Look inside some of the most Lucrative Industries