For over a decade and a half now, since Airbnb emerged onto the scene in 2008, property owners engaged in the vacation rental market have grappled with a pivotal decision: Airbnb vs Renting. Even within the niche of dynamic pricing companies catering specifically to rental property, the perennial inquiry persists regarding the comparative profitability, ease of management, and reliability of traditional renting versus embracing the Airbnb model.

In all honesty, the crux of the matter boils down to how much time and effort you can afford to allocate to managing your vacation rental property. For those entrenched in a traditional 9 to 5 job, the relentless turnover of guests inherent in an Airbnb setup may appear overwhelming compared to the relative stability offered by long-term rentals, where one tenant may stay for several months or even years.

In this comprehensive post, we undertake a thorough examination of the Airbnb vs Renting debate, scrutinizing it through the prism of three key parameters: ROI (return on investment), Operating Cost, and Management Time. Our focus extends beyond mere comparison, delving into the nuances and intricacies associated with both a short-term and a long-term rental property.

More About Airbnb

Established in 2008 by two entrepreneurial friends seeking to capitalize on their spare room, Airbnb has evolved into an unparalleled force in the tourism industry. With a staggering 4 million hosts and over 6 million Airbnb rental property listings worldwide, its reach spans across continents.

From one-night stays to extended months-long leases, Airbnb properties cater to diverse needs, all at the short-term rental owner’s discretion. Initially conceived as a platform for short-term rentals, Airbnb’s influence extends far beyond mere vacation rentals.

It has become a cornerstone in the realm of a traditional rental property, revolutionizing the way property owners manage their investments. Today, Airbnb represents not only a platform for short-term rentals but also a lucrative avenue for property owners to tap into the burgeoning market of long-term rentals.

More About Renting

When we refer to ‘renting’, we’re talking about vacation rentals that are leased on an annual basis. If you’re moving to a new city, it isn’t wise to look for a new home on Airbnb. These traditional rental properties are priced per day.

When you’re looking to rent a rental property on an annual basis, it’s priced per month, which usually means the daily cost is lower. Renting on a longer-term basis means fewer guests, less admin, and more dependable rental income, but that consistent income could potentially be much lower than the same period could generate on vacation rental sites like Airbnb.

Airbnb vs Renting: Return on Investment

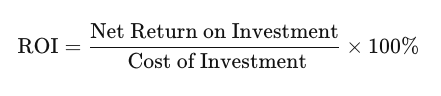

Let’s start with the basics, what is ROI (Return on Investment)? According to Forbes.com, Return on Investment is “a simple ratio that divides the net profit (or loss) from an investment by its cost. Because it is expressed as a percentage, you can compare the effectiveness or profitability of different investment choices.”

What this essentially means is ROI is a way to determine whether or not the money you have invested in something has generated any return and if it has, what percentage of return it has generated in relation to that initial investment.

Forbes goes on to say that “Just keep in mind that ROI is only as good as the numbers you feed into your calculation, and ROI cannot eliminate risk or uncertainty. When you use ROI to decide on future investments, you still need to factor in the risk that your projections of net profits can be too optimistic or even too pessimistic. And, as with all investments, historical performance is no guarantee of future success.”

Before you can calculate the ROI, you first need to consider the initial investment costs. Of course, this depends on the size of the investment property, its location, the amenities it has, and the way you purchased it – cash vs mortgage.

Investopedia advises that you calculate ROI with this simple calculation:

Image Copyright: Investopedia

Return on Investment Continued…

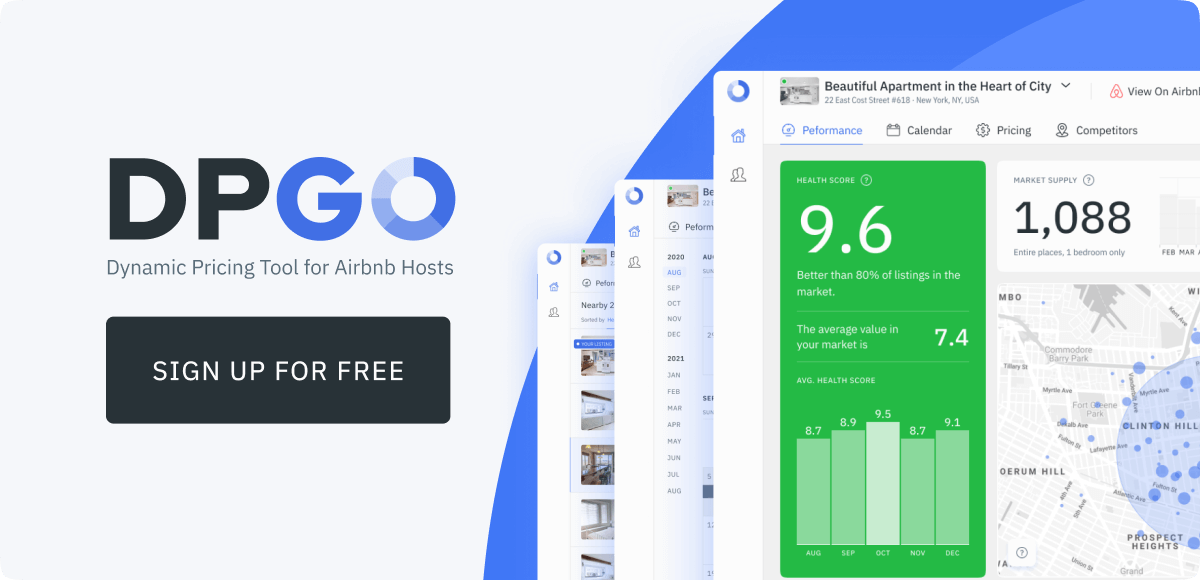

Without actual figures, you won’t be able to calculate ROI accurately. So if you’re just starting, then approximations may have to do for now. Work out what you would charge for monthly rent over a 12-month lease. Then head to Markets by DPGO to calculate the average daily rate, occupancy rate, and day-of-the-week price factor.

These insights will help you create a profile for what your passive income potential could look like from an Airbnb investment property perspective. We would love to be able to tell you which would earn you more money – Airbnb vs Renting – but there are too many variables, and therefore each case is completely unique.

TOP TIP: Remember that the vast majority of Airbnb properties see reasonably stark seasonal changes in the short-term rental market. Your predictable income over peak season is going to be considerably higher than that of off-peak season.

Airbnb vs Renting: Operating Cost

In the rental game, you’re always going to have operating costs, whether you opt for short-term rentals or long-term rentals. It’s also exceedingly hard to break down. Investopedia defines operating costs as being “associated with the maintenance and administration of a business on a day-to-day basis.

Operating costs include direct costs of goods sold (COGS) and other operating expenses—often called selling, general, and administrative (SG&A)—which include rent, payroll, and other overhead costs, as well as raw materials and maintenance expenses.”

Airbnb Operating Costs

- Internet

- Water

- Power

- Landlord Insurance

- Property taxes

- Consumable Amenities like tea, coffee, salt, and pepper

- Cleaning services or materials

- Laundry

- Property management software

- Dynamic pricing software

Long-Term Rental Operating Costs

- Long-Term Rental Maintenance

- Traditional Rental Insurance

- Property taxes

- Professional services like property lawyers on retainers

Airbnb vs Renting: Management Time

This is probably the biggest difference between short and long-term rentals. For vacation rental hosts, managing their properties can be a full-time job, depending on the length of your guests’ bookings. If your calendar is populated by shorter bookings, most of your day will be filled with laundry and cleaning.

However, if you hire a cleaning crew and a maintenance team, your list of daily tasks would be considerably shorter. For longer-term rentals, you really wouldn’t have much to worry about on a daily basis.

Long-term tenants don’t like to be bothered, especially if they’ve signed an annual lease agreement . Rather, make sure that they have your updated contact information and encourage them to contact you if they have any issues. It’s better to leave the ball in their court and allow them to contact you when there is an issue.

Conclusion

Okay, so after all of the discussion, which do we think is better – Airbnb vs renting? In our eyes, it depends on the type of host/landlord that you want to be. Airbnb rentals are hugely profitable in summer, but they take a dip in winter. Long-term rentals represent a more consistent form of rental income, but they never reach the price highs of vacation rentals.

This is because the rent is fixed and charged on a monthly basis. The best configuration of traditional rental formats would be short-term for the three main months of summer, and long-term rentals for the other nine months. Sadly, very few long-term tenants would be willing to move out of the long-term rental for three months in order for you to make more money.

Plus, there is no guarantee you would succeed in filling that three-month period with enough bookings to equal your normal tenant’s monthly rent. This depends on the location of your rental, the nature of your pricing, your property’s amenities, and the overall health of the tourism market at that time.

Comments are closed.