It’s no secret that investing in property is a great idea. But your intentions for your investment property very strongly affect where you should look to invest. In light of the fact that house prices are still rising and experts predict that the post-pandemic investment boom will keep going strong, we wanted to take a look at the best places to buy rental property in North America this year!

For ease of reference, we’ve arranged these locations in alphabetical order and we’ve separated our United States and Canada insights so you can click on the link and jump straight to the section that you want to read!

United States

Atlanta, Georgia

Albuquerque, New Mexico

Charlotte, North Carolina

Cincinnati, Ohio

Dallas, Texas

Orlando, Florida

Birmingham, Alabama

Boise, Idaho

Canada

Whistler, British Columbia

Quebec City, Quebec

Tofino, British Columbia

Niagara Falls, Ontario

Best Places to Buy Rental Property in the United States

These are the best markets that we’ve identified in the United States for vacation rental property investments in 2022.

Atlanta, Georgia

Atlanta has 6,520 vacation rental homes, and while that number might intimidate you, it means that there is a demand in this area for short-term rentals. Our data shows that the average daily rate in Atlanta, Georgia is $133 with an occupancy rate of 42%. Of that 6,520, 5,639 are entire home listings with 3,144 of those being a one-bedroom property.

Albuquerque, New Mexico

Our data for Albuquerque, New Mexico shows that the average daily rate in the area is currently sitting at $124. There are a total of 1,294 active listings and the majority have set either a 1 or 2-night minimum stay.

Charlotte, North Carolina

Charlotte, North Carolina is a great addition to our ‘Best Places to Buy Rental Property in North America’ list because it’s such an iconic location. There are 2,667 active locations in Charlotte, with an average daily rate of $144. While it’s not a particularly high average daily rate, Charlotte is a great vacation rental investment location because the market is popular and the investment rates are steady.

Cincinnati, Ohio

Cincinnati has a total of 1,039 active listings at the time of writing this blog post. It’s not peak season yet, so it’s likely that this number will increase. As will the average daily rate, which is currently sitting at $112. Most of the hosts in Cincinnati, 45% in fact, have opted for a 1-night minimum stay requirement. The rest are spread between 2- and 3-night stay minimum requirements.

Dallas, Texas

Dallas, home of the Dallas Cowboys, has a total of 2,825 active listings, with 675 of these being located in the heart of Dallas city. The average daily rate is sitting at $119, which should increase as the summer season approaches. The two most popular minimum stay requirements are 1- and 2-nights, with 36% and 31% respectively. The occupancy rate, which is calculated as an average of all the active listings in the market, is sitting at 64%.

Orlando, Florida

Orlando has a whopping 5,789 active listings. The average daily rate is $200 and the market is currently carrying an occupancy rate of 70%, which is impressive for any season other than summer! Listing prices reach their peaks on Friday and Saturday nights, with most hosts opting to set a 2-night minimum stay requirement to capitalize on this.

Birmingham, Alabama

While you may not have expected to see Alabama’s second most populous city on our ‘Best Places to Buy Rental Property in the United States’ list. Well, Birmingham has 530 active listings, which means the level of competition is low, but the green state attracts plenty of visitors! The average daily rate is $110 with an occupancy average of 64%.

Boise, Idaho

Boise, Idaho has 1,148 active listings with an average occupancy of 77%. The average daily rate currently is $128 with hosts in the area most commonly selecting 1- or 2-night minimum stays, with 35% and 44% respectively.

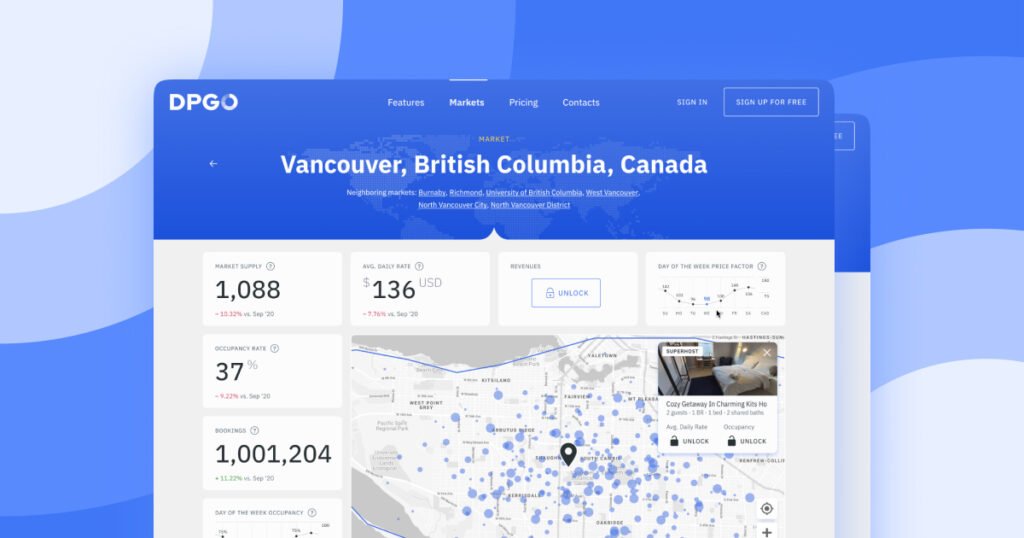

You can check these markets and more on Markets by DPGO!

Best Places to Buy Rental Property in Canada

Whistler, British Columbia

Whistler is, and always will be, a great vacation rental property investment location because the market is so popular. According to our data, there are 2,110 active listings in Whistler, with an occupancy rate of 59%. The average daily rate is currently $347, with the most expensive days being Friday and Saturday, but only marginally more expensive. Generally speaking, hosts in Whistler have selected a 2- or 3-night minimum stay requirements with a total of 34% and 33% respectively.

Québec City, Québec

Quebec City is one of the most picturesque cities in all of Canada and it is in fact a gateway market! In March 2022, this market has 992 active listings with an overall average occupancy rate of 60%. Like most markets, the prices go up on Friday and Saturday and most hosts in Quebec City have opted not to set a minimum stay requirement.

Tofino, British Columbia

Tofino is a beautiful area of British Columbia and the market boasts 282 active listings. The average daily rate is $285 with an occupancy rate of 78%. Tofino hosts have most commonly selected a minimum stay requirement of 2 nights.

Niagara Falls, Ontario

Niagara Falls is beautiful and it attracts thousands of tourists every year. Staying in the stunning surrounding area means tourists can access the falls very easily. In total, Niagara Falls has 406 active listings with an average daily rate of $176. The occupancy rate for the Niagara Falls market is currently sitting at 45%.

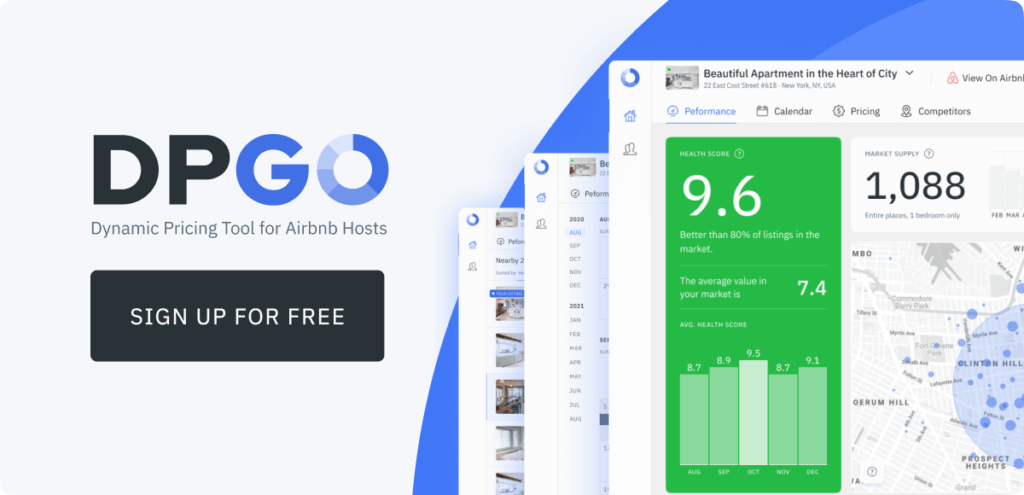

How Can DPGO Help?

DPGO collects and analyzes mass amounts of short-term rental data across every market in North America. We then use this data to generate dynamic pricing recommendations and revenue management strategies.

We’ve developed a few ways for you to access this data: Markets by DPGO, our Free Usage Plan, and our two full-service pricing options – 0.5% of the booked price or $1 per booked night.

Sign up by clicking the banner above!

Comments are closed.